Markets Ripping; Economy Slowing (Update to "Looking Sideways")

This piece is an update and follow up to my August 26th piece, Looking Sideways: Comments on Markets, Mimetics and the Madness of Crowds.

The real economy looks shaky, at best. Inflation remains persistently above the 2% target and the job market is weakening.

A healthy economy should do two things: keep prices steady and provide good jobs. Strip away the jargon and the “macroeconomy” boils down to two forces: inflation and the labor market. Growth matters not for its own sake, but because it signals that people are working and wages are rising. When we talk about “the real economy,” we’re really just talking about jobs and paychecks.

A few weeks ago in Looking Sideways: Comments on Markets, Mimetics and the Madness of Crowds, I warned that even as public markets hit record highs, the madness of crowds was back convincing investors and common folk that things are fine when they’re not. The data I laid out suggested otherwise. Since then, markets have only grown more fevered.

Let's look at some more data.

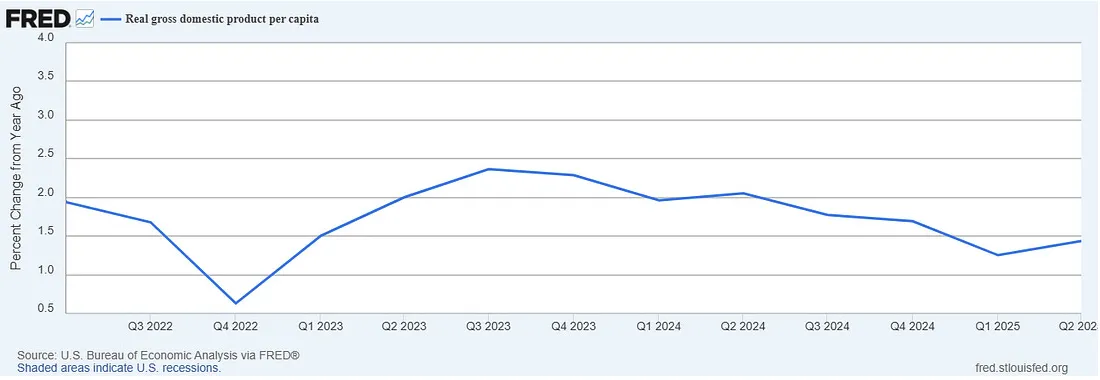

Economic growth under Trump has been slowing. Not recession territory slowing, yet, but slowing nonetheless:

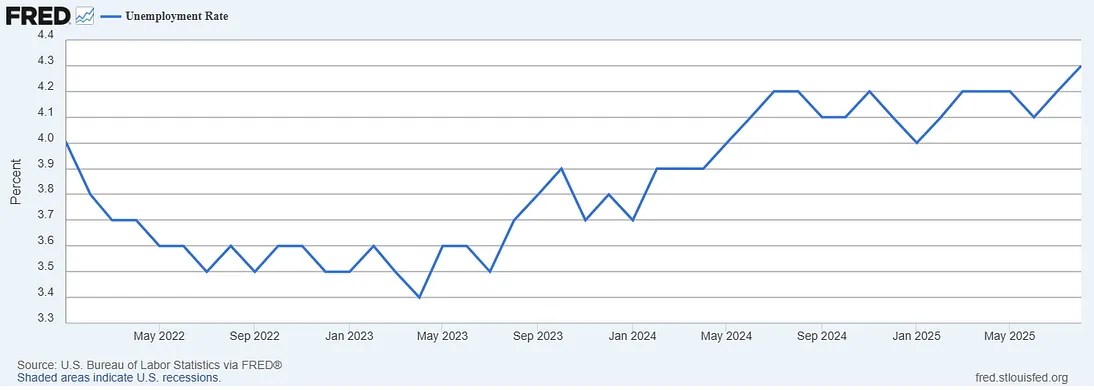

Since we only get GDP data every three months, the labor market is the better real-time gauge. The two key signals to keep an eye on are jobs and unemployment. The jobless rate is still under 5% (low by historical standards) but it’s edging higher.

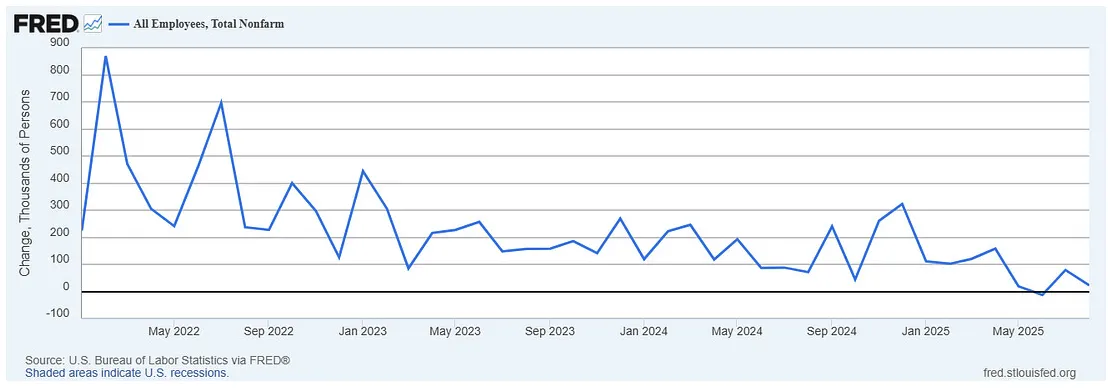

Not terrible, but the other major jobs measure, the monthly tally of new positions employers add, is looking grim. The Bureau of Labor Statistics says the U.S. created just 22,000 jobs in August, far below the 75,000 economists expected. The year-on-year comparison is worse: 598,000 jobs so far in 2025, compared with 1.14 million in the first eight months of 2024. That’s a 50% drop, and the decline has only accelerated since Trump announced his “Liberation Day” tariffs in April:

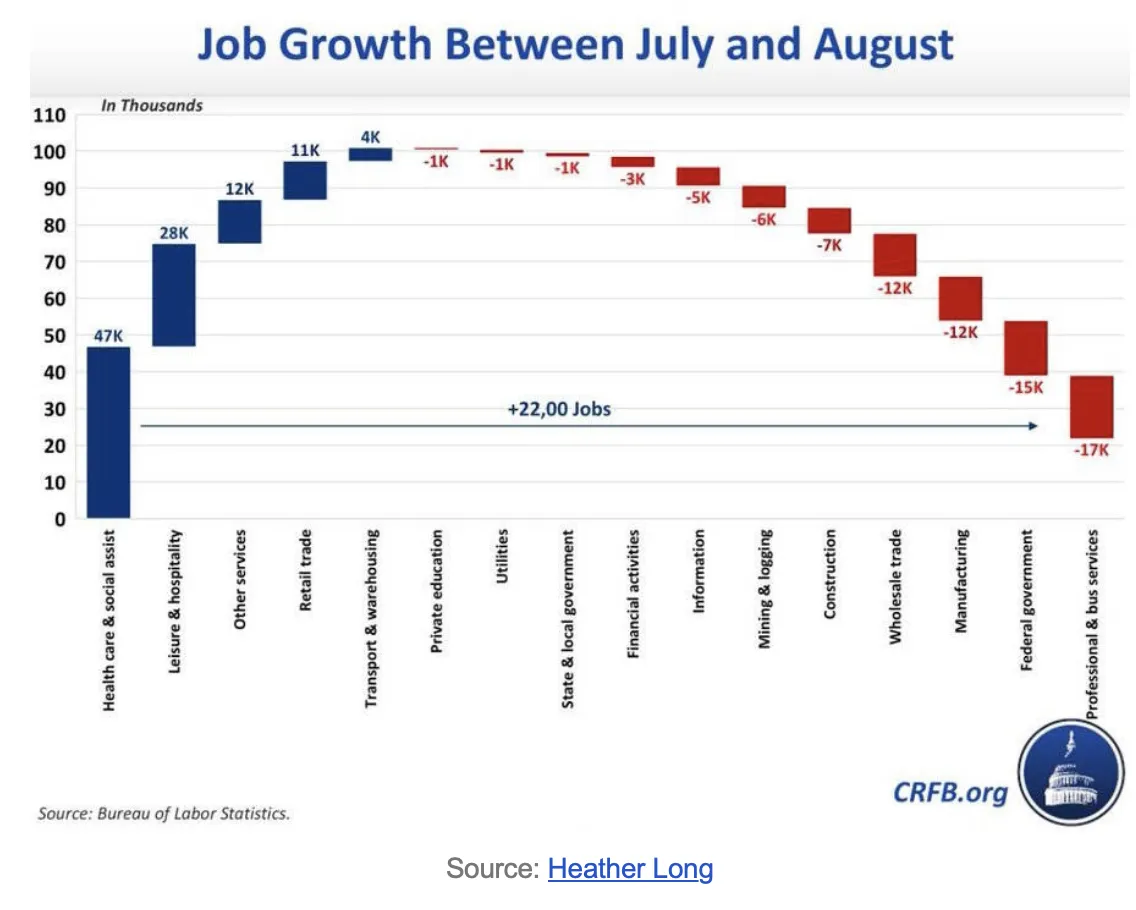

Then there's this. For all the nonsense about immigrants stealing jobs, the sectors actually losing steam aren’t those that rely heavily on undocumented labor:

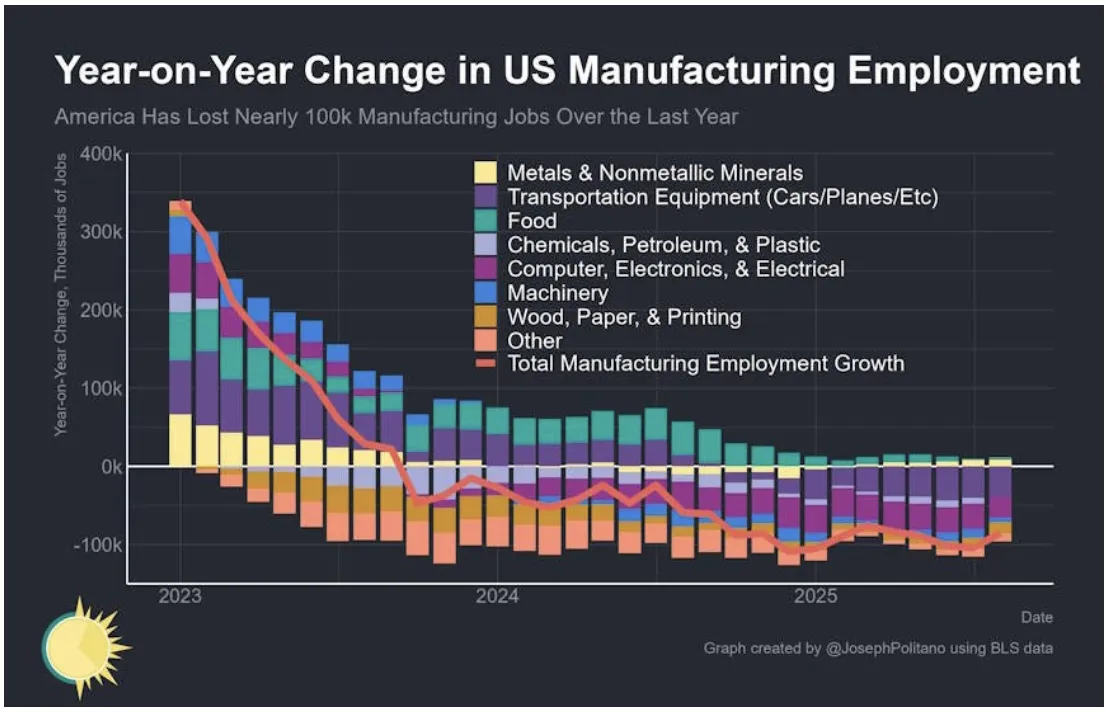

Remember Trump’s big promise to bring manufacturing back home? All those ribbon-cutting photo ops and breathless announcements about shiny new factories in small towns (looking at you, Apple). Not so fast. In 2025 alone, the U.S. has already shed about 80,000 factory jobs. Manufacturing was already sliding in 2024 (probably fallout from rate hikes) but the drop has only steepened since Trump took office:

Manufacturing is, of course, uniquely exposed to tariffs because of its reliance on supply chains. Did policymakers not think of that?

Finally, let's go around the horn and look at the most recent jobs data from other important sources, namely ADP, Bloomberg, and outplacement firm Challenger, Gray & Christmas:

- Hiring is slowing:

"Private payrolls increased by just 54,000 in August, according to data from processing firm ADP published Thursday morning. That's below the consensus forecast of 75,000 from economists polled by Dow Jones, and marks a significant slowdown from the revised gain of 106,000 seen in the prior month."

- Jobless claims are rising:

"Applications for US unemployment benefits rose to the highest since June, adding to evidence that the labor market is cooling…Initial claims increased by 8,000 to 237,000 in the week ended Aug. 30."

- Job openings are falling:

: "US job openings fell in July to the lowest in 10 months, adding to other data that show a gradually diminishing appetite for workers amid heightened policy uncertainty…Available positions decreased to 7.18 million from a downwardly revised 7.36 million in June, according to Bureau of Labor Statistics data published Wednesday. The median estimate in a Bloomberg survey of economists called for 7.38 million openings."

- Hiring plans reduced; more job cuts announced:

"Hiring plans fell to the weakest level for any August on record and intended job cuts mounted amid broader economic uncertainty, according to outplacement firm Challenger, Gray & Christmas. US-based companies announced in August plans to add 1,494 jobs, the fewest for the month in data going back to 2009. Announced job cuts jumped from a year ago to almost 85,980 and marked the largest August total since 2020. Excluding the impact of the pandemic, the number was the highest for any August since the Great Recession in 2008.

The numbers aren’t pretty. But instead of facing them, it seems everyone is still staring sideways at each other, and ignoring the cold print in front of them. Denial has a cost. Sooner or later, the real economy of jobs, wages, and prices will come knocking, and when it does, the markets will crack.

The data I laid out here and in Looking Sideways: Comments On Markets, Mimetics, and The Madness Of Crowds still points to a coming market bust.

I hope by that point you've stopped looking around.